Our ...

July 2022 NewsletterAt the time of writing, we are in the midst of rapidly rising inflation and interest rates, the Tories are fighting a leadership battle and we’ve just experienced a heatwave of record breaking temperatures. The thermometers have now dipped, but with inflation due to remain high for the foreseeable, we ask, are there investments that could outperform in an inflationary environment? We also look at ways to reduce your exposure to the Additional Rate of tax and, regardless of your tax rate, we examine some tax considerations to bear in mind in the event of the death of a spouse or civil partner.

We hope you find the articles useful.

In this issue:-

- Inflation and Value Investing

- Beware of Hasty Pensions Decisions

- Reducing Exposure to the 45% Rate

- Tax Effects on Death of Spouse or Civil Partner

- State Pensions – time is running out to backfill NICs record to 6 April 2006

- LPA registration time has doubled

- News from JJFS

Inflation and Value Investing

The news is filled with reports about rising inflation and many of us will have noticed the prices rise on our weekly food shops or when filling up the car (even if it is electric).

With this backdrop, we ask, what investments could outperform in an inflationary environment?

Historical data seems to show that value investing strategies have outperformed growth strategies, on average, during inflationary periods.

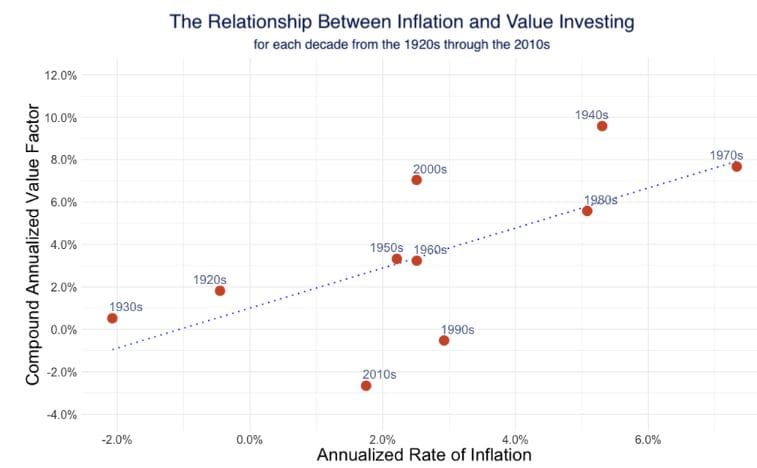

The positive relationship between value investing and inflation can be validated as far back as the 1920s. This can be seen in the following chart:

Source: Euclidean Technologies; as at October 2021.

From this graph, we believe it can be inferred that value investing tends to outperform during periods of high inflation.

Why does this relationship exist?

To understand the answer to this question, we must recognize that the opposite approach to value investing is growth investing. Growth investing values companies based on their future expected earnings, as opposed to their past or present earnings. Furthermore, inflation, by definition, is the process by which money in the future becomes less valuable than in the present. Therefore, in higher inflation periods, future earnings become less valuable and current earnings become correspondingly more valuable. Since “value stocks” are valued on their near-term earnings, it follows that inflationary periods should be better for value stocks than for growth stocks and vice versa.

With inflation hitting multi-decade highs across the US, UK and other developed markets, we may be entering a period where value investing outperforms growth investing – a shift from what has transpired over the past several years.

As an example, using recent data relating to the S&P 500 for the year-to-date, the expectation of value outperforming growth in an inflationary environment has been vindicated within the S&P 500, the world’s largest market.

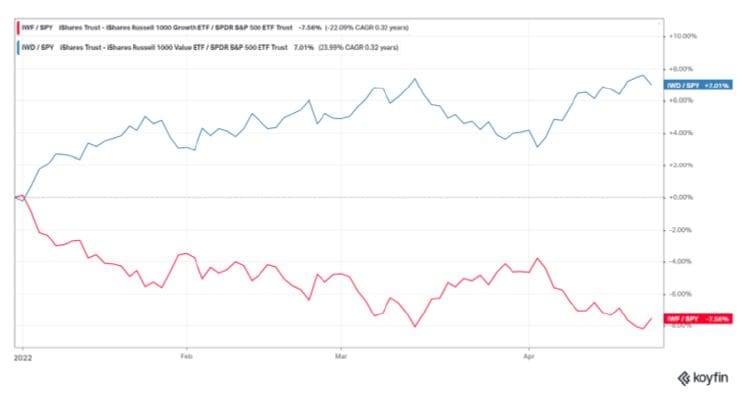

The chart below shows the relative performance of value versus the S&P 500 and growth versus the S&P 500. As can be seen, so far this year, value is outperforming the S&P 500 and also significantly outperforming growth: [apologies for quality of the image]

RED = IWF/SPY iShares Trust – iShares Russell 1000 Growth ETF/SPDR S&P 500 ETF Trust -7.56% (-22.09% CAGR 0.32 years)

BLUE = IWD / SPRY iShares Trust – iShares Russell 1000 Value ETF / SPDR S&P 500 ETF Trust 7.01% (23.99% CAGR 0.32 years)

Source: Koyfin; as at 26 April 2022.

The example only shows the results for one market for one year and results may vary over longer time periods and different markets.

Of course, we cannot be certain that the out performance of value investing in an inflationary environment will continue, but it’s important to be aware of this potential turning of the tide.

Beware of Hasty Pensions Decisions

The current squeeze on people’s incomes might lead some people to consider drawing on savings. The Low Incomes Tax Reform Group (LITRG) is concerned that hasty decisions to take money out of pensions could lead to costly mistakes and is urging people to exercise caution and seek help.

LITRG’s warning comes after the recent launch of a Government call for evidence on ‘Helping savers understand their pension choices’.

Pension flexibility means that many people with ‘money purchase’ or ‘defined contribution’ pension savings can do effectively what they wish with their accumulated pot of money, from age 55.

While tax relief is usually given on money saved into pensions and investment growth is tax free, tax will likely have to be paid when money is taken out. Some of the knock-on effects can be unexpected and, without careful planning, can leave people with less money than anticipated.

An individual is allowed to take some money (usually 25%) out of their pension tax free, but the rest (usually 75%) is taxable as income. Taxable amounts will be added to other income, probably resulting in an extra tax bill.

We therefore urge people not to rush into making decisions about pension withdrawals without fully exploring the tax and other consequences of their actions.

Ideally planning ahead will help you to pay less tax on withdrawals, if it is taken in stages, spread out over a number of tax years, or withdrawn after you completely stop work. For those on lower incomes, tax credits and benefits also need consideration – for example, the taxable element of pensions is also taken into account as income for tax credits.

If you are looking to take money out of a pension to get you through a spell of financial difficulty, you might wish to pay into a pension again in future if the squeeze on your income eases. However, once you have taken pension benefits under the pension flexibility rules, future tax relief is restricted such that you are limited to paying in £4,000 gross a year, the ‘money purchase annual allowance, which is a possible tax trap to beware of.

Reducing Exposure to the 45% Rate

High income individuals

The 45% income tax rate applicable to taxable income in excess of £150,000, together with the loss of the basic personal allowance for those with ‘adjusted net income’ over £100,000, should spur those affected to take action to reduce or eliminate exposure to the resulting additional tax.

Strategies that fully exploit the opportunities for couples to maximise the use of allowances and exemptions as well as the lower rates of tax are even more worthwhile reviewing for high income individuals.

To give a little more detail, the stepped reduction in the basic personal allowance for those with ‘adjusted net income’ over £100,000 is achieved by reducing the basic personal allowance by £1 for every £2 over the £100,000 limit with the allowance being lost completely when income reaches £125,140 in 2022/23. This means that income of £25,140 (the excess over £100,000) that would otherwise have been charged to tax at 40% effectively suffers tax at 60%.

What can be done with investments?

There are numerous possibilities for couples to minimise their overall tax liabilities. Here are five of them:

1) Invest where the income (and gains) is tax free. The most obvious investment here is the ISA. Each person is entitled to invest a maximum of £20,000 a year.

2) Invest in assets that produce capital gains rather than income. The rate of capital gains tax (CGT) is 10% on gains within the basic rate tax band and 20% for gains in the higher and additional rate tax bands and each individual (regardless of age) is entitled to an annual exemption of £12,300 (currently frozen at this level until 2025/26) meaning net gains of £12,300 can be generated by each spouse or civil partner in a tax year free of tax.

3) Invest in assets that defer the tax charge or additional tax charges. UK investment bonds suffer an internal rate of tax of 20% or less (depending on the make up of the fund). On encashment, a 45% taxpayer would currently have an additional 25% tax to pay and a full 45% if the gain is realised from an offshore bond. However, it may be that encashment can be deferred until the investor is retired and / or paying tax at a lower rate.

Alternatively, the investment bond could be assigned to a spouse or civil partner, or grown-up child, who does not pay tax at 40% or 45%. The assignment would count as a potentially exempt transfer (PET) for inheritance tax (IHT) purposes but would not give rise to an income tax charge as no chargeable event occurs. This is so regardless of whether the transferor is married to / in a civil partnership with the transferee. On subsequent encashment, any gain would be assessed to income tax on the transferee.

4) Transfer income-producing assets from the spouse or civil partner in the higher tax bracket to the spouse or civil partner in the lower tax bracket. Such assets can include bank deposits, shares, collectives, investment bonds and rental property.

For new investments, subject to non-tax considerations, thought could be given to joint ownership. There would be no adverse CGT consequences as a transfer between spouses or civil partners living together would be on a no gain / no loss basis.

Where a personal savings allowance (PSA) and / or dividend allowance is available, the transferror may decide to retain some assets. Savings income that falls within the PSA is tax free. For basic rate taxpayers the PSA is £1,000 a year, for higher rate taxpayers it is £500 a year, but no allowance is available for additional rate taxpayers.

5) By taking action to increase the basic rate tax or higher rate tax limits, it is possible to save income tax and CGT. One method of achieving this is to pay a contribution to a registered pension scheme whereby the basic rate tax band is increased by the gross pension contribution, e.g. a personal pension contribution where tax relief is given at source. The same result can also be achieved where a gross pension contribution reduces taxable income thereby freeing up some of the basic rate tax band, e.g. an occupational pension contribution deducted from salary before tax or an AVC to an occupational pension scheme. Effective tax relief of 60% or more can be obtained on pension contributions where clients are also able to reclaim their personal allowance. However, care has to be taken over the annual allowance and the tapered annual allowance and clients need to have sufficient relevant earnings (e.g. employment income or self-employed trading profits) to support the required pension contribution.

If you have any queries or would like assistance with your own retirement planning, please get in touch with your usual JJFS contact or email us on justask@jjfsltd.com.

Tax Effects on Death of a Spouse or Civil Partner

This is a subject that most of us will not wish to dwell on but it is worth being aware of some of the tax implications and of course we are here to help and answer your queries.

Effect on personal allowances

When a spouse / civil partner dies, his or her tax affairs, up to the date of their death, are dealt with on the basis of them receiving the full personal allowance and, if eligible, married couple’s allowance. The remaining spouse / civil partner obtains their usual personal allowance for the year.

Bereavement payments

For deaths on or after 6 April 2017, Bereavement Allowance (previously Widow’s Pension), Bereavement Payment, and Widowed Parent’s Allowance were replaced by a new Bereavement Support Payment. This is worth £3,500, plus £350 a month for 18 months, for claimants with dependent children (£2,500 plus £100 a month for other claimants). To qualify, the surviving partner must be under the state pension age and living in the UK or a country that pays bereavement benefits, when the deceased died and the deceased must either have paid ‘sufficient’ National Insurance contributions prior to his or her death, or his or her death must have been caused by their job. The Bereavement Support Payment is not taxable and is disregarded in the calculation of other means tested benefits.

For deaths on or before 5 April 2017, Widowed Parent’s Allowance (up to £126.35 per week in 2022/23) may still be available if the survivor has at least one dependent child and the deceased was the child’s parent. This payment is taxable.

Those in receipt of bereavement payments prior to 6 April 2017 continue to receive them for as long as they remain eligible. Widowed Parent’s Allowance can continue to be received by the survivor until they either stop being entitled to Child Benefit or reach State Pension age.

A new claim for Widowed Parent’s Allowance can only be made if the deceased died before 6 April 2017 and the cause of death has just been confirmed.

Capital gains tax

On death, regardless of who benefits under the deceased’s Will or intestacy, there is no capital gains tax payable and the assets comprised in the estate of the deceased are revalued.

Inheritance tax

Transfers on death between spouses or civil partners, both of whom are UK domiciled or deemed UK domiciled are exempt from inheritance tax (IHT).

Where the deceased was domiciled and the donee (surviving) spouse or civil partner was not UK domiciled or not UK deemed domiciled then since 6 April the first £325,000 (previously £55,000) of the amount transferred on death will be exempt/ In addition, a full nil rate band would also be available.

And, since 6 April 2013 a non-UK domiciled spouse or civil partner can elect to be treated as UK domiciled meaning that transfers would then be exempt for IHT purposes. However, advice should be sought prior to making such an election as worldwide assets will then be within the scope of UK IHT.

If you have any queries or would like assistance with your own IHT planning please get in touch with your usual JJFS contact or email us on justask@jjfsltd.com.

State Pensions – Time is Running Out to Backfill NICs Record to 6 April 2006

When the new State Pension was introduced from 6 April 2016, the Government also provided an easement to the normal six-year window which allows individuals to pay Voluntary (Class 2 or Class 3) National Insurance Contributions (NICs) to fill in gaps as far back as 6 April 2006. However, this easement is coming to an end on 5 April 2023 meaning individuals have a little over nine months to take advantage of this easement.

This was picked up in the Telegraph (telegraph.co.uk of 18 June 2022): How to boost your state pension by £55,000.

The headline grabbing figure of £55,000 is based upon the increase in State Pension following backfilling ten qualifying years, increasing an individual’s State Pension by £52.90 per week and paid for an assumed 20 years from State Pension Age (SPA).

If you haven’t already it would be good to obtain a State Pension forecast and check your NICs record, both of which can be done online.

Before topping up

However, people considering topping up need to take a range of factors into account.

For example:

- Some years can be ‘cheaper’ to top up than others; for example, people who have worked part-year and have paid some NICs may be able to complete that year more cheaply than buying a completely blank year;

- Filling blanks for certain years (particularly those before 2016/17) can sometimes have no impact on your State Pension. This is particularly relevant for people who have already paid in 30 years by April 2016 and who were long-term members of a ‘contracted out’ pension arrangement;

- People who expect to be on benefits in retirement may find that some or all of any improvement in their State Pension may be clawed back in reduced pension credit or housing benefit;

- People who were self-employed can save money by paying voluntary Class 2 contributions (currently £163.80 per year) rather than Class 3 contributions (£824.20 per year);

- Before paying voluntary NICs, individuals should see if they can claim NICs credits for a particular year. For example, those looking after grandchildren may be able to claim credits transferred from the child’s parent, and this could be a cost-free way of boosting their State Pension.

There are two groups for whom top-ups may be of particular interest:

- Early-retired public servants, or private sector individuals who have been members of a ‘contracted out’ occupational pension scheme; the period of contracting out is likely to reduce their State Pension below the maximum amount, and their early retirement is likely to mean they have ‘gaps’ in their NICs record which can be filled;

- The self-employed, who may have gaps in their NICs record and may be able to go back to any year since 2006/07 to top it up; this group is less likely to be affected by complications around ‘contracting out’.

In a blog post entitled “Can I boost my state pension?” there is an interactive tool produced by the firm Lane Clark & Peacock LLP that is intended to guide individuals through a series of quick questions, based upon details found on their State Pension forecast to decide whether it is beneficial for them to look at paying voluntary NICs. This tool represents the views and understanding of Lane Clarke & Peacock LLP and the link to their tool is provided strictly for general consideration only and no action must be taken or refrained from based on this. Specialist advice must always be sought.

For help and further information please get in touch with your usual JJFS contact or email us at justask@jjfsltd.com

LPA Registration Time Has More Than Doubled

The Office of the Public Guardian (OPG) target to register a lasting power of attorney (LPA) is 40 days but the current average time to register an LPA is currently running at 81.8 days.

This is according to a written parliamentary statement from Parliamentary Under Secretary of State (Ministry of Justice) Tom Pursglove who informed the House of Commons that the pandemic has been a large factor towards the slowdown. However, OPG staff are working day and night to tackle the Covid backlog and extra staff have been hired. The number of LPAs being registered each month is over 70,000 which is the same as pre-pandemic levels.

As part of the process, the OPG must carry out checks on receiving the LPA before notices are issued and then wait four weeks, which is a statutory obligation to allow for objections, before the process can be completed.

According to the Society of Trust and Estate Practitioners (STEP) the LPA paper process is currently time-consuming and onerous and needs to be digitally updated in line with other online court systems.

The significant backlog of applications will remain and may take many months to process although last month, the Government unveiled plans to modernise LPAs and speed up the registration process.

Plase let us know if you need to set up an LPA and we will put you in touch with our LPA contact.

News from JJFS

The team are enjoying working together again in the office and we have been doing so for a good few months now. Simon recently completed the 2 Castles run, for the 5th time. This is the popular 10km run between two of England’s most beautiful castles, Kenilworth and Warwick. The weather was kind providing warm but breezy conditions and Simon finished in a respectable time of 53 minutes.

Hannah took part in the Stratford Boat Club fun regatta last weekend and her team came an impressive second. She stood in at short notice for some friends who were taking part but having competed a few years previously, it was like riding a bike and the rowing skills soon came back – thankfully remaining dry with no embarrassing over-board incidents!

Michelle continues to be a key volunteer with the local scouts, including the annual camp out. She’s looking forward to her summer break to catch up on some sleep.

Helen, meanwhile, maintains a more sedate pace outside the office and is honing her bee keeping skills. We are still waiting for the JJFS honey production line to begin.

PLEASE NOTE:

These articles do not constitute any form of personal advice or recommendation and are not intended to be relied upon in making (or refraining from making) any investment or financial planning decisions.

Sign up for our

newsletter

Stay up to date with important issues that affect your finances

Pension freedom

download

Esssential reading if you are considering accessing the funds in your pension

Auto Enrolment for

employers

What is auto enrolment and what are employers required to do?